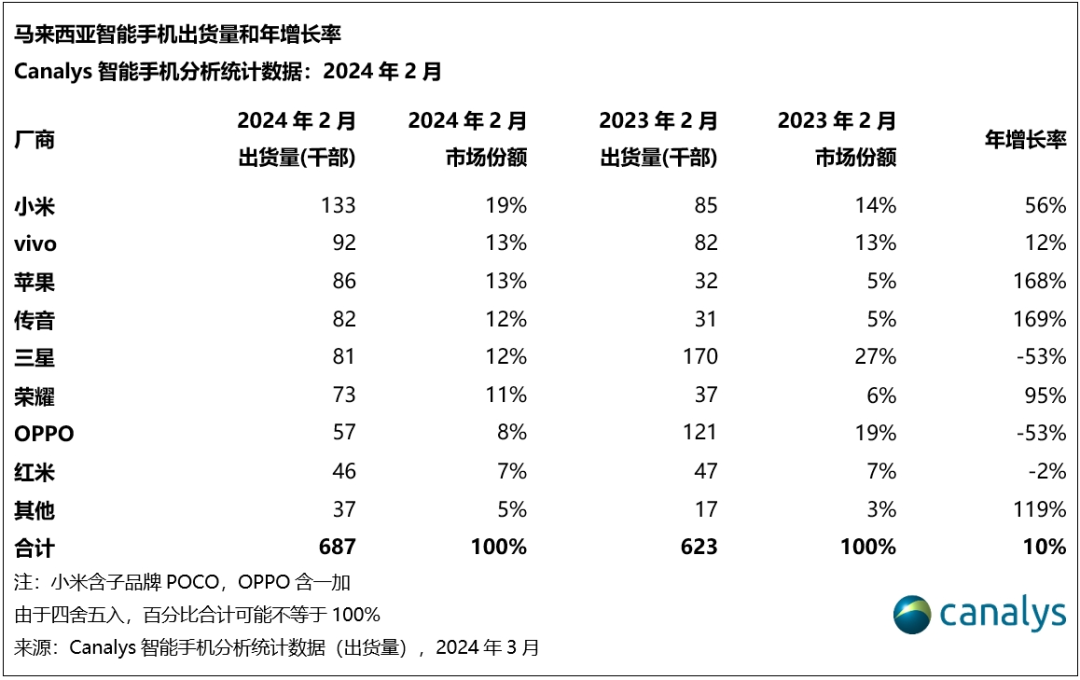

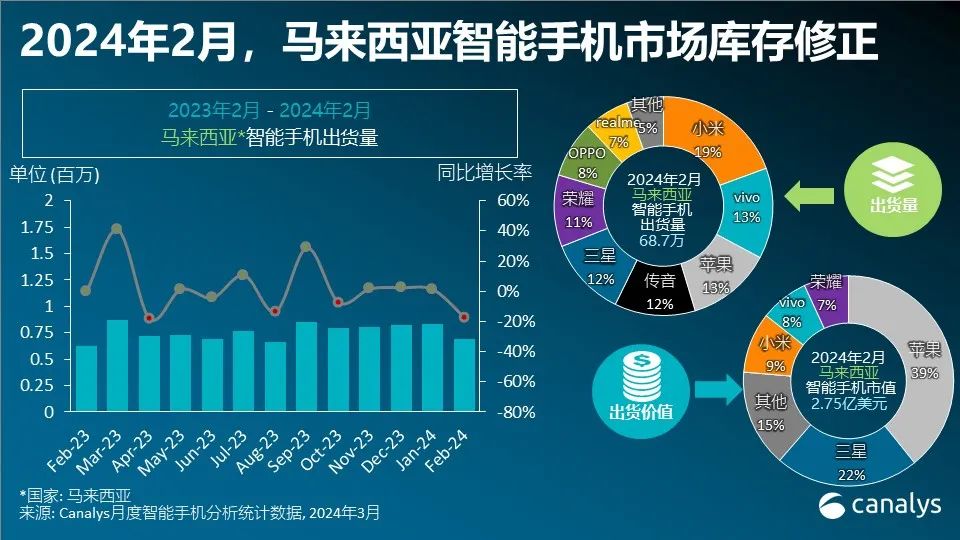

Malaysia's smartphone shipments jump 10% in February 2024

Top 5 Malaysian Manufacturers Highlight Performance, February 2024

Xiaomi led February 2024 shipments, surging 56 percent year-on-year to ship 133,000 units, led by cost-effective models such as the newly released Redmi A3 and Redmi 13C.

Vivo followed with a 13% market share and 92,000 units shipped, with its lead model Y100 5G capitalizing on the country's increasing 5G penetration with its cost-effective pricing of MYR1,199 (~USD250).

By expanding its sales channels and introducing telco Yes Mobile, Apple's shipments jumped 168 percent year-on-year to 86,000 units, while also topping the charts in terms of sales. However, the sharp price cuts for the iPhone 15 series earlier this year showed that market demand remains relatively weak compared to the growth in shipments.

Transsion shipments grew 169 percent year-on-year to 82,000 units, with its go-to and high-priced models such as the Infinix Hot 40 series and Tecno Spark 20 series highly sought after by smaller distributors in the open channel.

Samsung shipped in fifth place, up 12 percent, but its sales were up 22 percent to second place. With its flagship Galaxy S24 series and mid-range and high-end models A35 and A55, Samsung sales are expected to increase significantly in the first quarter of 2024.

market dynamics

In the entry-level market, smartphone vendors are stepping up price competition and utilizing channel incentives to boost shipments and market share. Core configurations, pricing strategies and channel margins are all key factors in the success of sub-MYR1,000 (~US$200) models, while 5G capabilities are increasingly becoming a selling point in the sub-MYR1,400 (US$290) price segment. hugely popular models such as Vivo's Y17s and Xiaomi's Redmi 12 have succeeded in finding a balance between these factors.

For high-end smartphones, it is increasingly important to provide customers with an omnichannel buying experience. This requires manufacturers to fully understand the customer buying experience across online and offline channels, and then create a smooth and consistent experience. Samsung excels in this regard, with its official website offering customers the option to pick up the device at a physical store. While much of the Galaxy S24's launch marketing campaign was predominantly online, Samsung's vast network of authorized stores also provided customers with prototype experiences for testing Galaxy AI features such as real-time translation.

Market Outlook

Canalys expects the smartphone market in Malaysia to grow 9.5% year-on-year in 2024 to 9.8 million units. The channel will consolidate further as retailers' margins continue to shrink. The telco channel and large retailers will gain more market share, while smaller independent resellers will be pushed out of the market. In addition to their strengths in infrastructure and financial resources, large retailers and telecom operators can get a better handle on customer switching cycles through installment plans, traffic packages and other sales activities.

The continued penetration of cost-effective 5G devices remains an important growth factor, especially as mainstream telecom operators themselves offer 5G devices. In addition, telcos are also including 5G traffic packs for free in most prepaid traffic plans. 5G penetration in the prepaid market is expected to stimulate demand for cost-effective 5G devices, further widening the 5G threshold from telcos to the open channel. Smartphone vendors will increase their cooperation with telecom operators such as Maxis, CelecomDigi and Hotlink to launch their cost-effective 5G portfolios to the mass market.

Canalys analyst Zhou Sheng Yong said, “Smartphones in Malaysia grew 10% year-on-year in February 2024, with 687,000 units shipped. Vendors' measures to increase sales and normalize inventory in Q4 2023 create room for growth in Q1 2024. The smartphone market is poised for further growth in 2024, driven by peak smartphone shipments in 2021 and the natural replacement cycle.”